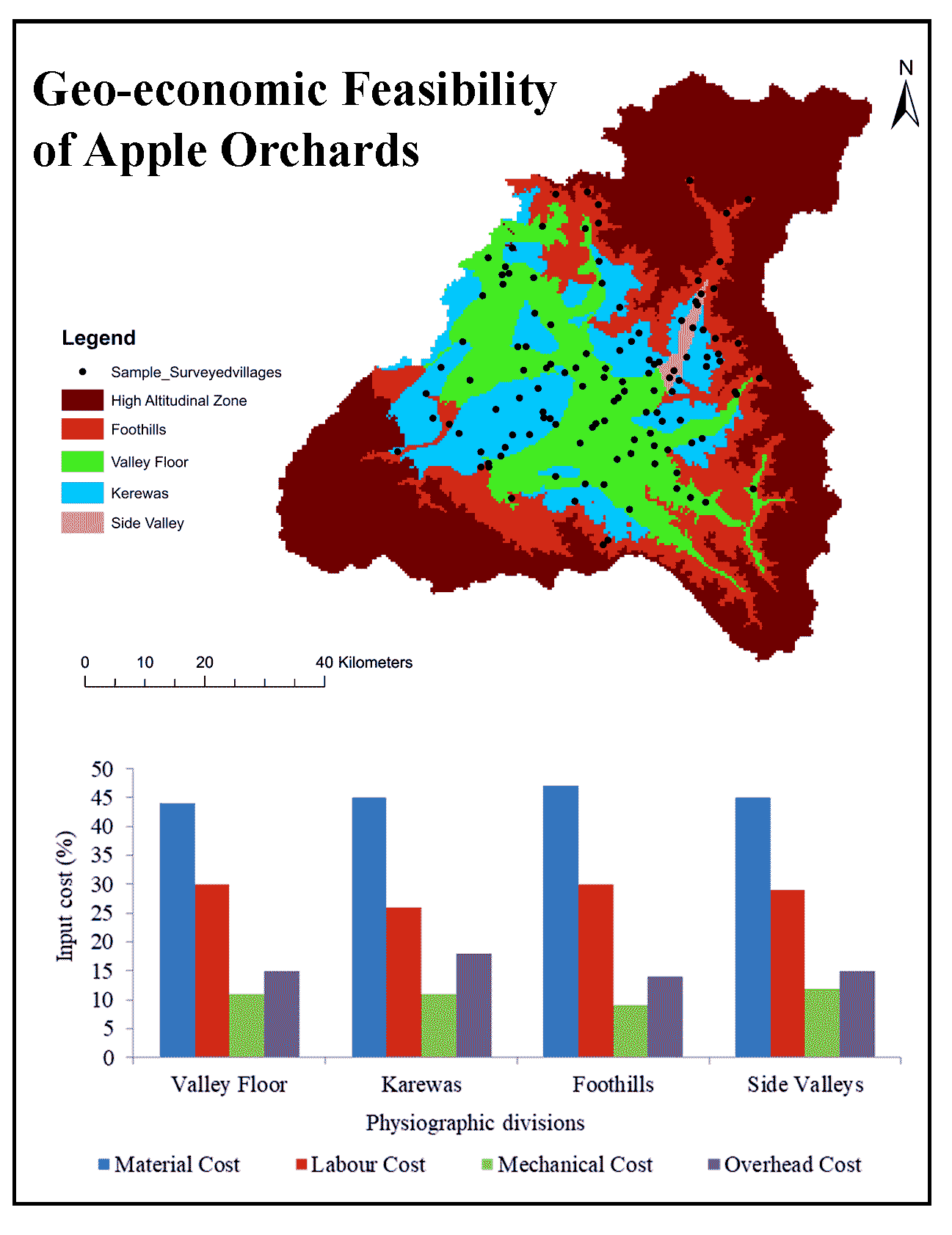

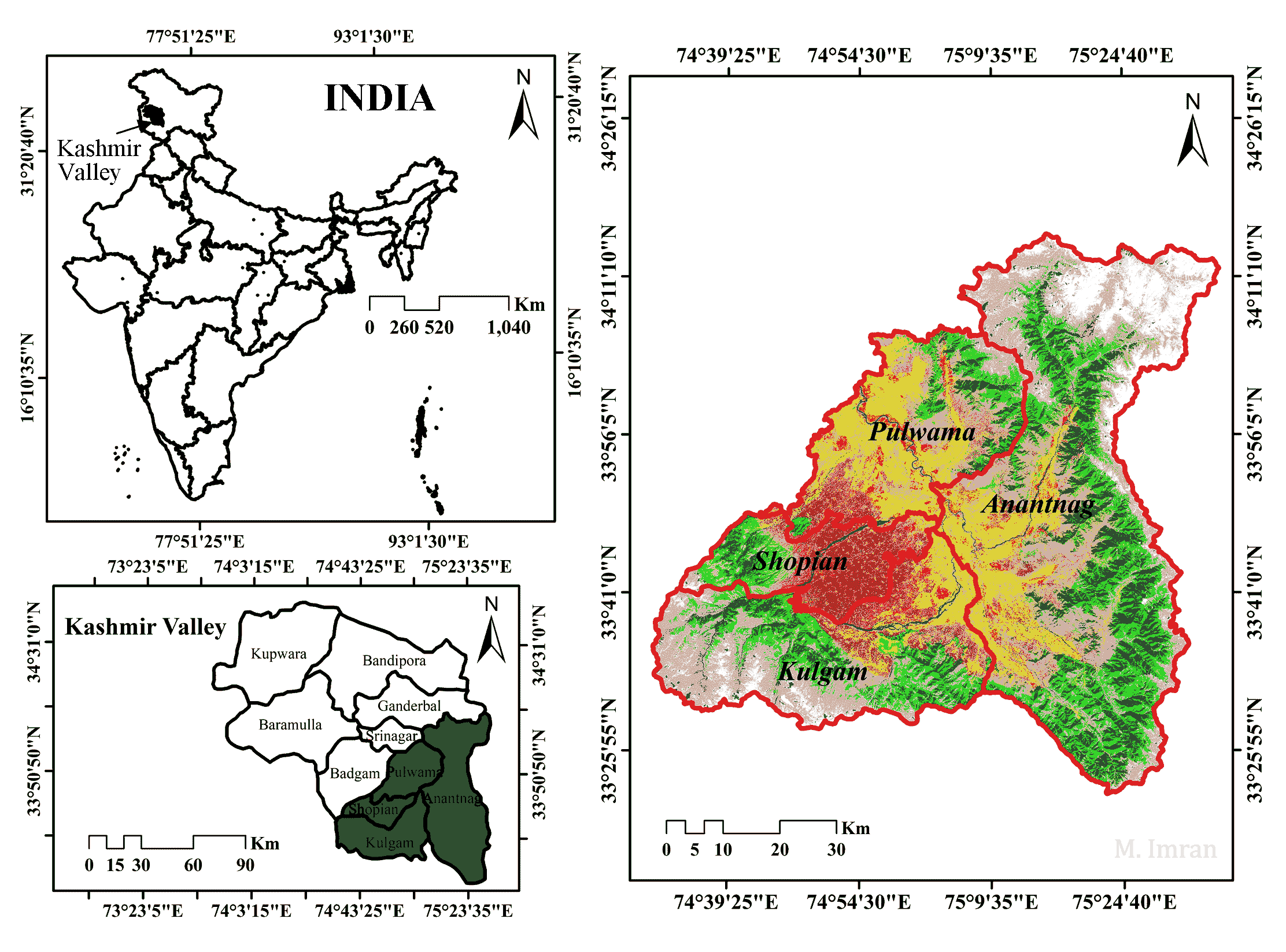

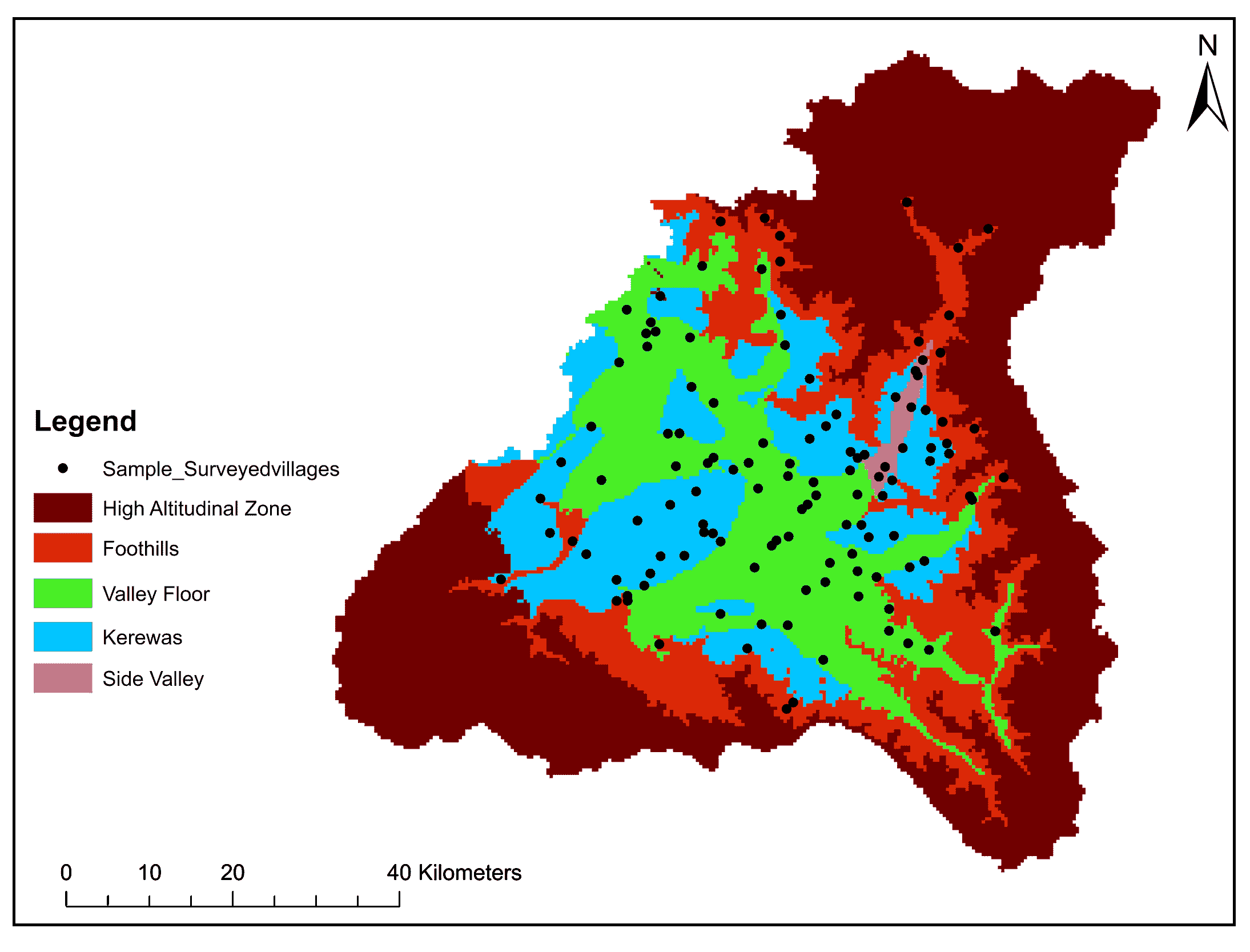

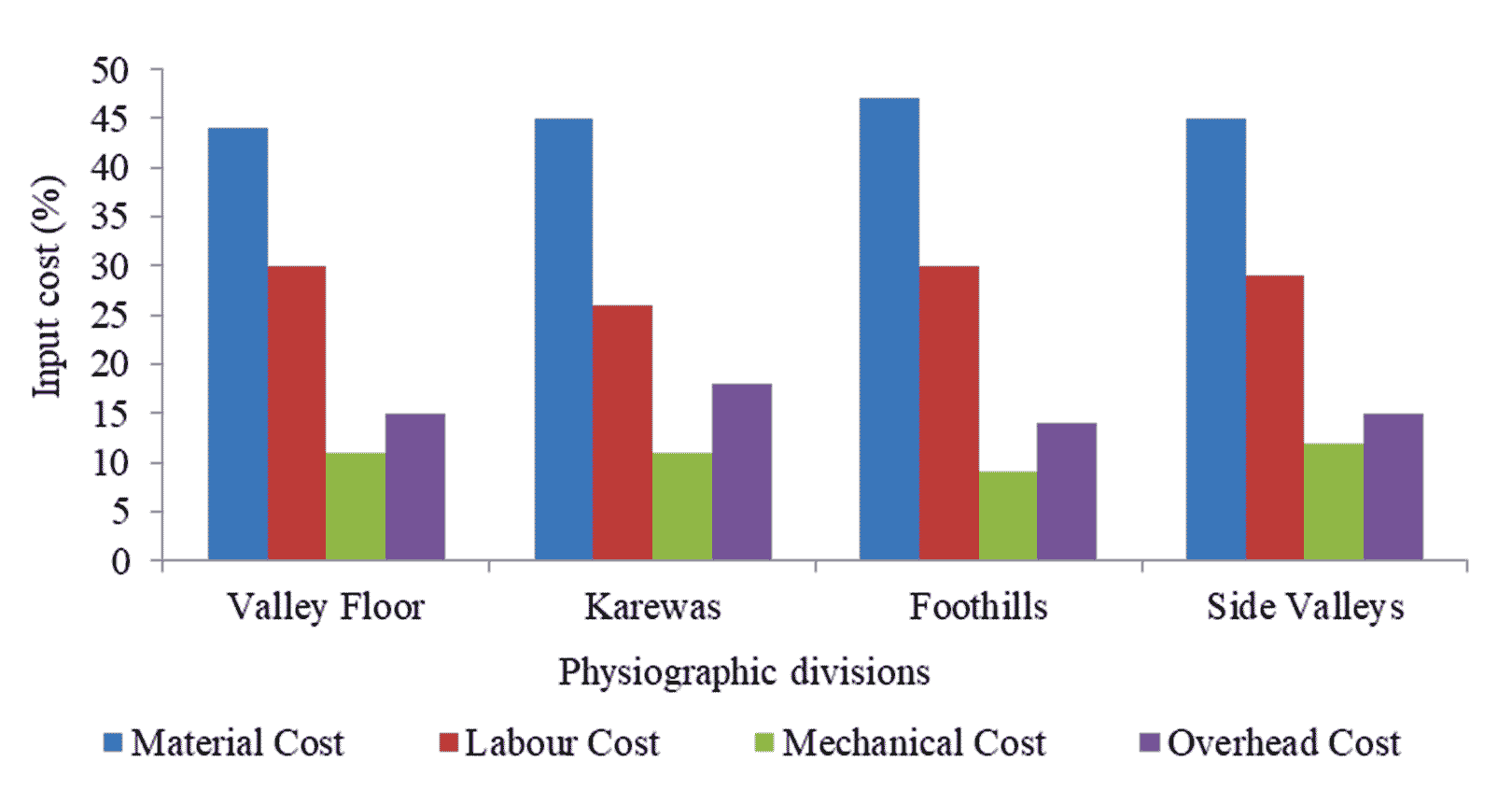

The study employed data from both primary and secondary sources. Primary data were collected in order to estimate the input and output cost empirically. For sampling purpose, the South Kashmir region of the Kashmir valley was specifically chosen because it has predominant horticulture, allowing for more reliable study results. South Kashmir is divided into four administrative districts: Anantnag, Pulwama, Kulgam, and Shopian (Ganaie et al., 2022a, 2022b). Moreover, this region has high agricultural and horticultural development (Ganaie et al., 2014). A basic unit of land measurement in the research region is the kanal’ (0.05 hectare), on which the analysis was based. The study area was delineated into four physical divisions, viz, valley floor, karewas, foothills and side valley. The physiographic map was generated using SOI toposheets on a 1:50000 scale a digital elevation model (DEM) and geological maps of karewas, as well as comprehensive field observations for ground verification and post-processing. The villages that fell inside each physiographic zone were identified by superimposing the village map over the physiographic map to determine the sample locations (Figure 2).

In each physiographic zone, 10% of the villages were randomly selected, and 2% of the farm-operating households in each village were administered a survey for sampling. This led to the generation of 866 surveys at the farm-household level, divided into four physiographic groups. The data was collected pertaining to all the costs incurred on apple orchard starting from its establishment to the production and marketing stage. Based on data provided by apple farmers, the annual mean during the fructification stage was used to calculate the level of output and the price per unit. The evaluation of economic feasibility of an apple orchard involves a complex set of indices that cover various aspects of investment appraisal (Badiu et al., 2015). The life of an apple orchard in the study area is around 40 years (traditional orchard system). As such the methodology must include the time value of money. In the present study, we are employing widely used investment appraisal methods viz. net present value (NPV), internal rate of return (IRR), and payback period (Sojkova and Adamickova, 2011). Besides, cost-benefit ratio and descriptive statistics were also employed for data analysis.

3.1 Net Present Value (NPV)

Any economic venture, including a crop, is said to be viable if the predicted additional gain surpasses the total input costs incurred during the production phase. Any perennial crop such as apple involves time and calculating aggregate cash inflows occurring in subsequent years require adoption of appropriate discount rates to calculate the present value of future flows. Indeed, this is one of the guiding principles since discount rates should accurately reflects the opportunity cost of the capital to permit a comparison of the value of money in different periods. The net present value is calculated by the following mathematical expression (Erkus and Rehber, 1998):

\(NVP = \sum^n_{t=1} {(Bt-Ct) \over (1+r)t} -I_t\)

Where

\(Bt\) = benefits at time t, \(Ct\) = cost at time t,

\(I_t\) = investment cost, n = project economic life,

r = discount rate

In our study, the net present value was calculated at the discount rate of 7.5% which also represented the opportunity cost of capital.

3.2 Internal Rate of Return (IRR)

IRR is the discount rate that produces zero NPV. Therefore, it is equivalent to the discount rate r that satisfies the following relationship (Badiu et al., 2015):

\(NVP = \sum^n_{t=1} {(Bt-Ct) \over (1+r)t} =0\)

where, Bt is the benefit stream and Ct is the cost stream.

The economic activity (an apple orchard in our case) is profitable if IRR is greater than the interest rate that could be earned in alternative investments; thus when IRR > ‘r’ the activity is considered viable. If ‘r’ also called opportunity cost of capital is lower than the IRR, then NPV is positive and vice-versa. This is expressed as:

\(IRR>r=I^{mkt}=NPV>0\)

\(IRR<r=I^{mkt}=NPV<0\)

3.3 Payback Period

Taking the changing value of money into consideration, the payback period is defined as the period (years) for which the discounted net cash inflow will cover the discounted value of each investment. The payback period of a project satisfies the following relationship (Badiu et al., 2015).

\(Payback \ period = \sum^n_{t=0} {I_k \over (1+i)t} =\sum^n_{t=0} {NI_k \over (1+i)t}\)

where,

\(I_k\) = Value of investments in the kth year

\(NI_k\) = Net income of the activity in the kth year disregarding the value of the investments.

,

Showkat A. Ganaie 1

,

Showkat A. Ganaie 1

,

M. Imran Ganaie 2

,

M. Imran Ganaie 2

,

M. Shafi Bhat 3

,

M. Shafi Bhat 3

,

Javeed A. Rather 3

,

Javeed A. Rather 3